This page was last edited at 0155 GMT London Friday 17 October 2008:

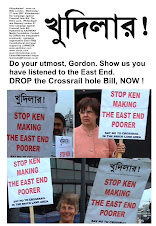

KHOODEELAAR! TOLD YOU SO! The wasteful, crassly conceived, Big Business scam Crossrail is not economically supportable... It should ne scrapped, thus saving £Billions of public money.... Money should be spent on IMPROVING the EXISTING Transport infrastructure and the quality of transport SERVICE in London for the London public...

[To be continued]

"

Construction output could be slashed as result of bank bail out

17 October 2008

By Sarah Richardson

Economists warn that public spending may be slashed over next three years

The rate of decline in construction output over the next three years could double if the government reins in public spending after its £50bn bail out of Britain’s banks.

The warning, from the Construction Products Association (CPA), came after the government spent £37bn on shares in the Royal Bank of Scotland, HBOS and Lloyds TSB.

The move should improve the short-term fortunes of the industry by unlocking capital. But economists have warned that the cost of the deal will put the government under pressure to cut investment levels announced in last autumn’s Comprehensive Spending Review – and leave the industry with workload that decreases faster than expected over the next three years.

The CPA calculates that if the government cut back its spending to 2007 levels during 2009 and 2010, output would fall 12% between now and 2011. At present the association is predicting a 6.7% decline, which is based on the assumption that investment in education, healthcare and infrastructure will offset falling demand in the private housing and commercial sectors. It is now urging the government to keep to its spending commitments despite the financial upheavals.

Jonathan Hook, head of construction and engineering at Pricewaterhouse Coopers, said: “The bail out is a double-edged sword. There are an awful lot of positives in terms of what it does for the market, and existing PFI schemes will be easier to fund. The downside is that there must be question marks over the public sector spending programme. More likely than scrapped, programmes could be delayed.”

Despite committing itself to capital spending of more than £70bn by March 2011 in the Comprehensive Spending Review, the government can, in theory, change its plans by arguing that the economic situation has changed.

Experts said this week that such a move would be unlikely to come in November’s pre-Budget report, but that it may be on the cards by next spring.

Michael Ankers, chief executive of the CPA, said: “I think it will take some time to work out if the situation has stabilised, and then the government will have to decide on a strategy – whether they have no option but to cut, or whether they think the recession is so bad they need to spend to keep the economy going.”

Richard Whittington, UK head of building and construction at KPMG, said that whether or not Labour remained in government beyond the next election he expected cuts. He said: “The tax take will be down, and bigger projects across all sectors could be at risk.”

Transport

Transport infrastructure, despite a planned investment of almost £10bn until 2011, is likely to be the first casualty should public spending be cut, as many infrastructure projects are relatively costly without being obvious vote-winners. Road spending would probably be first on the block, and economists have also expressed doubt over the £16bn Crossrail scheme, as it’s often easier to take a big slice of spending out in one go.

Education

Education is a safer bet than transport owing to its popularity with the electorate, but the government may still look to slow down spending on schemes such as the £45bn Building Schools for the Future programme (without visibly scrapping any schools). A spend programme of £2.3bn on universities could be mothballed without a public outcry, and the fact that the £7bn primary schools programme does not start until next spring makes it possible that this could be slowed.

The NHS

This sector is likely to escape cuts, according to the experts. With an ageing population inclined to become irate at any decline in the quality of care, and a proportionately smaller amount of public spend to play with, the NHS is likely to escape largely unscathed. The £1bn express Lift programme, announced earlier this month, should go forward, and the sector will be boosted by the trend away from large PFI projects, which would have sucked up capital.

Housing

With private housing starts at record lows, and the government maintaining that it wants to build 3 million homes by 2020, it is unlikely to cut back new-build social housing. The target of 45,000 social homes by the end of the spending review period is unlikely to be reached, but that will not be because of less money in the pot. If the government does cut back, it’s more likely to be on its decent homes initiative, as repair and maintenance isn't so visible to voters.

“The bail out is a double-edged sword... Most likely programmes could be delayed”

Jonathan Hook, PwC

WHERE THE AXE COULD FALL

-

Back in October 2007, when many economists were still cheerfully predicting that the Northern Rock nightmare would be a blip rather than a recession, the government announced more than £70bn of capital spending between 2007 to 2011 in its Comprehensive Spending Review. But how safe is that investment now?

"

Subscribe to:

Post Comments (Atom)

![Khoodeelaar! constitutional law campaign against the 'Crossrail Bill' [a Bill in UK Parliament]](http://2.bp.blogspot.com/_pSmwp9aFK8U/SGqe5VQwLHI/AAAAAAAABfc/MEjjMWby2dc/S226/Khoodeelaar!+try+this+logo.gif)

![London [Rupert Murdoched] Times, Wed. 7 May 2008](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEitiFRN6uO_MOdYMby0s7ow2zcBaewOKfl3k4QdCPcahu1IKXx6sl7Gs4aO9VrAhN8gQJvYb1a2JnODsTUsMks_LtoZVuqc64whMkMitNKVz1bijPST853uNwRNG8x2PVFl1kqRez8M3b-j/s226/1676149.jpg)

No comments:

Post a Comment